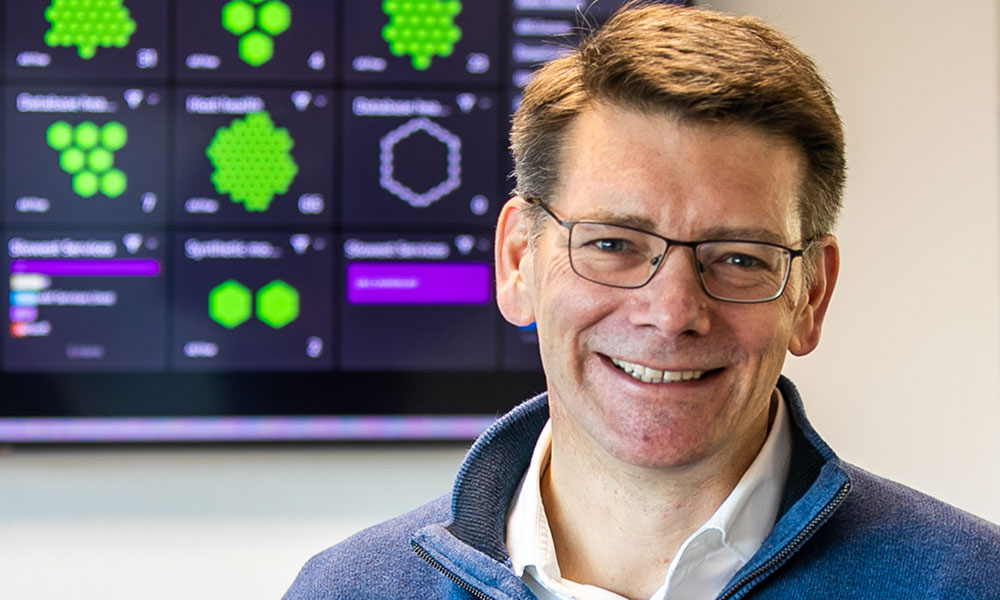

Q: Can you tell us a bit about your role and how your department/teams deliver against the purpose?

My role has 3 main elements:

1: Day-to-day pricing, product, and value management. These teams monitor our trading performance, looking at how many mortgage applications we’ve had, how many savings accounts have been opened and how much members have deposited into their savings. They’ll consider any competitor price changes in the mortgage and savings markets and then judge whether we need to make any change to our rates factoring in, profit, volumes, and risk and make recommendations to changes to the rates on the products we offer.

2: Commercial development. This team looks at opportunities to help first time buyers and other potential borrowers. They develop new propositions and look at potential new markets which we might enter. They are central to fulfilling our purpose and have recently developed products to help first time buyers safely borrow more than they could previously, really supporting them getting the home they want.

3: Strategy. We’re responsible for helping the directors of LBS define and implement our strategy. Our purpose is clear, this function helps the organisation ensure we are set up and prioritising the right things to ensure we deliver against it.

Q: What does a typical day look like for you?

It’s a cliche but there isn’t really a typical day, which is why I enjoy my role so much. Mondays are the exception; we have our weekly pricing meeting where the team present proposals for approval before we change rates or launch new products. The rest of the week varies – I might be attending the Risk Committee (where we monitor the risk of borrowers not being able to pay their mortgage and assess whether we need to change the rules about the types of customers we lend to) or it could be in 1-2-1 sessions with my team, or it could be facilitating a meeting with our directors to shape our strategy.

Q: What skills are essential for someone working in a Product role?

I’d say that strong analytical skills combined with a good balance of both customer and commercial mindset is essential for all positions in product.

Q: What do you find most rewarding about working at Leeds Building Society?

Our purpose is inspiring. It feels rewarding when we launch a new proposition such as Reach (helping those with less than perfect credit history to get on the housing ladder) or Income plus that we now will help borrowers who are really struggling to fulfil their homeownership dreams.

Q: What has been the greatest opportunity for you and your team?

The clarification of our purpose has given my team a blank piece of paper to create brand new ways to help first-time buyers and those looking to move up the housing ladder. What greater opportunity could you ask for?

Q: How do we reward people and celebrate great work?

Great work is always recognised at the Society, and the Product department is no different. This could be anything from positive feedback, to team celebrations. The Society also has an excellent annual recognition scheme called Excellence in Action, and I’m very proud to say that over the years, we have had several nominees and winners in the team.

Finally, it’s not really a reward, more a perk, but there are some exceptional bakers in the team so there’s quite often cake for no real reason at all!!

Q: What advice would you give to someone looking to build a career in product within financial services?

Be flexible. It’s a very varied function dealing with analytics, problem solving, customers, regulatory influence, change management and a whole host of other things.